Economic momentum remains strong in emerging markets, focus shifts towards political risks. China: alongside a weak real estate sector, further trade tariffs create challenges for its economy. Economic outlook unchanged despite surprising election results in South Africa, India & Mexico.

Number in focus

Global trade barriers are increasing. The Biden administration has imposed tariffs on a number of Chinese goods, including a 100% tariff on the import of electric vehicles. At the same time, the EU Commission has announced an average additional tariff of 21% on Chinese electric vehicles. In the medium term, this will complicate, but not hinder, China’s efforts to use high-tech products as growth drivers. In addition, trade barriers necessitate greater localisation, which is more costly and supports our assumption of a higher inflation environment compared to the pre-pandemic period.

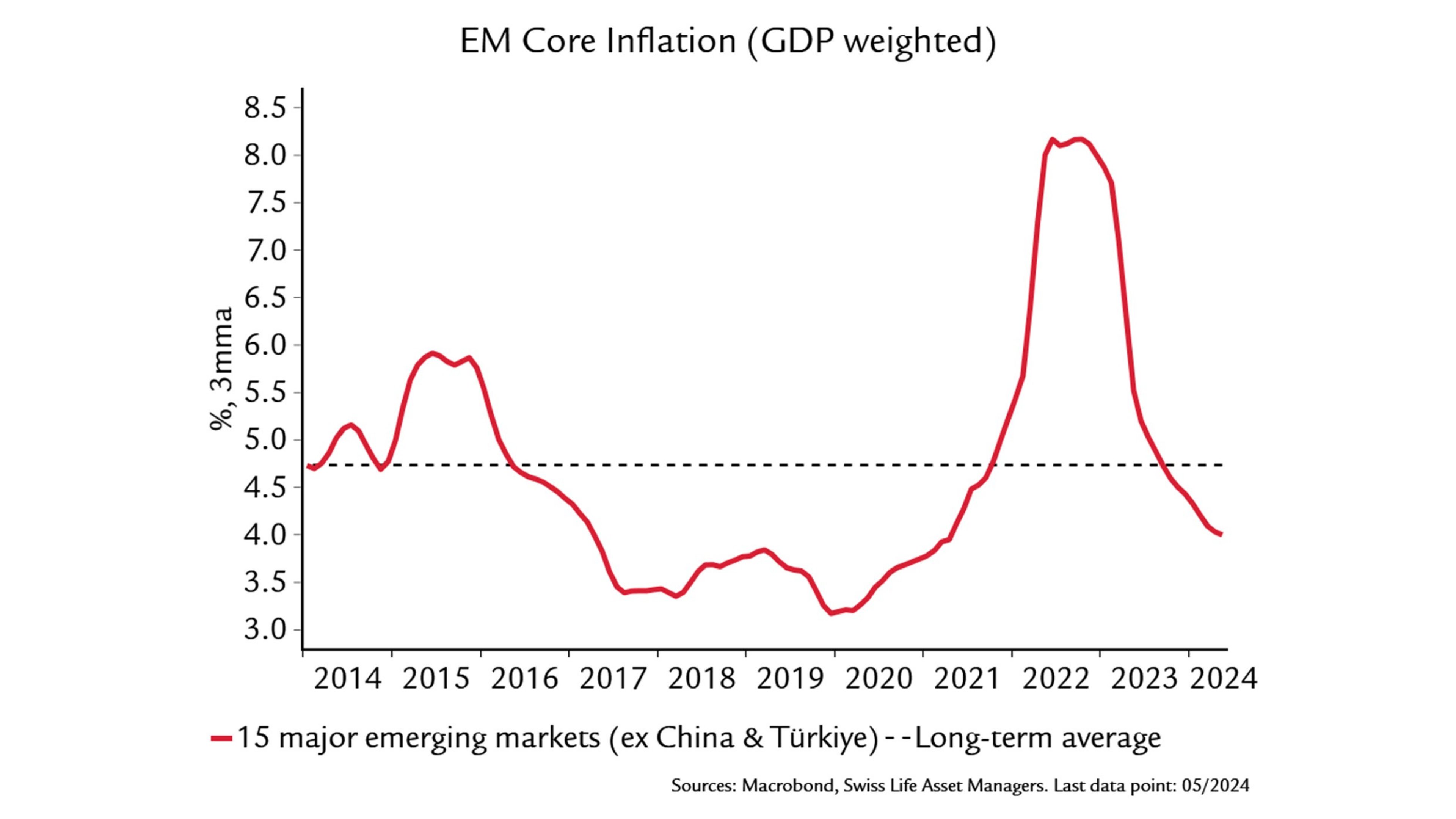

Chart in focus

Inflation in emerging markets continues to decline, and in some cases has already reached the inflation target of the respective central banks. The aggregate core inflation rate, which excludes volatile food and energy prices, has already returned to pre-pandemic levels for the 15 leading emerging markets (see “Chart in focus”). We have excluded China and Turkey from this aggregation due to the exceptional situation in these countries with regard to inflation.